On March 14, 2020, the House of Representatives passed the Families First Coronavirus Response Act (“FFCRA”), attempting to assist those affected by COVID-19. Before we could even get a detailed update on what this means for small- and medium-sized employers, the House made several substantive changes late Monday night. We have incorporated those changes into our update below.

We expect that this bipartisan bill will pass the Senate once it leaves the House and that President Trump, who publicly supported the bill, will sign it into law by the end of this week. Most of the provisions will take effect starting just 15 days from the day the President signs it. As you will see, the FFCRA is likely to have profound consequences for small- and medium-sized employers.

While the FFCRA contains eight different divisions, from appropriations to tax credits, this quick article tackles only the Emergency Paid Sick Leave Act (Division E) and the Emergency Family Medical Leave Expansion Act (Division C) that we think will impact employers the most and most immediately.

Emergency Paid Sick Leave Act

The Emergency Paid Sick Leave Act covers employers with fewer than 500 employees and requires employers to provide 80 hours of paid sick leave to their employees. There is no eligibility requirement for employees to receive this paid sick leave — all employees are covered by this provision of FFCRA, no matter how long they’ve been employed.

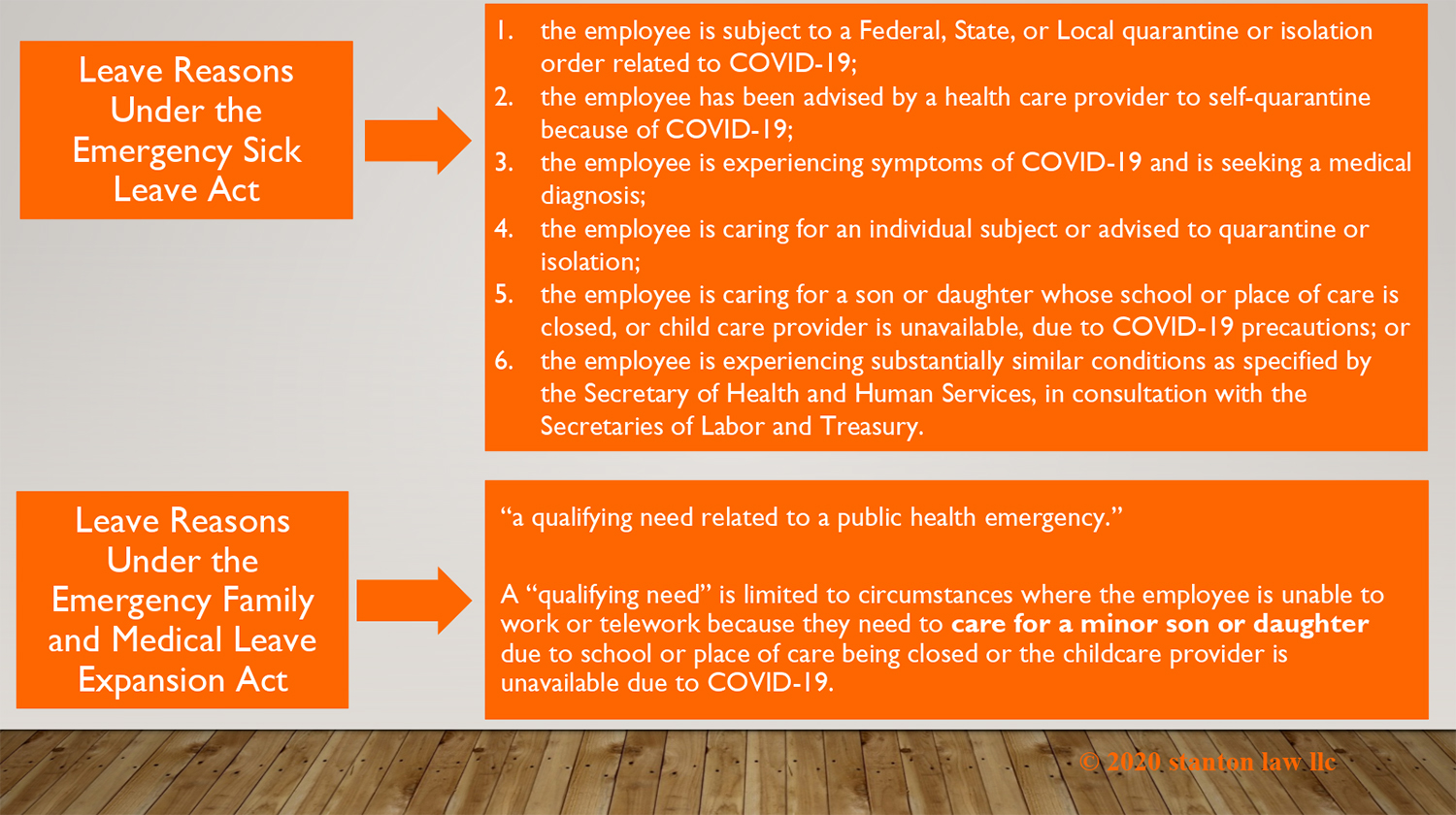

The amended FFCRA allows employees to take paid sick leave if they are unable to work or telework because of any of the following 6 reasons:

1. the employee is subject to a Federal, State, or Local quarantine or isolation order related to COVID-19;

2. the employee has been advised by a health care provider to self-quarantine because of COVID-19;

3. the employee is experiencing symptoms of COVID-19 and is seeking a medical diagnosis;

4. the employee is caring for an individual subject or advised to quarantine or isolation;

5. the employee is caring for a son or daughter whose school or place of care is closed, or childcare provider is unavailable, due to COVID-19 precautions; or

6. the employee is experiencing substantially similar conditions as specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury.

Employers are required to pay employees their full regular rate (as determined by the Fair Labor Standards Act) for reasons 1-3 (caring for employee’s own sickness). The amended bill limits the amount of paid leave for these reasons to $511 per day, for a total of $5,110. For employees taking leave for reasons 4-6 (caring for a family member), employers are required to pay employees two-thirds their regular rate. The amended bill caps this paid leave to $200 per day, for a total of $2,000. As for a part-time or varying-schedule employee, an employer must pay the employee the average number of hours the employee worked the previous six months prior to emergency paid leave. If the employee has worked for the employer for less than six months, then the employer must pay the average number of hours the employee would normally be scheduled to work based on the employee’s reasonable expectation at the time of hiring.

The amended legislation now exempts employers with 50 employees or less from this paid leave if the paid leave would jeopardize the business as a going concern but does not provide any direction or guidance as to how an employer would assert or apply this exemption. Since failure to pay this required paid leave will be treated as a failure to pay minimum wages under the Fair Labor Standards Act (FLSA), we highly encourage employers to comply with this mandatory paid leave provision.

And no, FFCRA does not specify from where the employer is supposed to get the money to pay the employee for not working. Tax breaks may be on the way, but as of now, there is no easy answer for how employers’ cash flow will absorb this mandated expense.

Neither is it clear how an employer can verify an employee’s reasons for leave – forms are not yet available. However, we are hopeful that the final version will clarify and permit certain documentation requirements.

With this new federally mandated paid sick leave on the horizon, an employer cannot change its current paid leave policy to avoid the new obligations of the Emergency Paid Sick Leave Act. Any sick leave employers currently offer their employees must stay in place and will be consider paid leave in addition to this new federal mandate.

This paid sick leave provision currently has a sunset provision at the end of the year, and any paid leave accrued under this provision will not carry over into the next year.

Emergency Family and Medical Leave Expansion Act

Another provision of the FFCRA, Emergency Family and Medical Leave Expansion Act, temporarily amends and expands the Family and Medical Leave Act (“FMLA”) to cover most employers. While the current FMLA only applies to companies with 50 or more employees, FFCRA changes the employee threshold to cover any workplace with fewer than 500 employees. If you were not a covered employer under the FMLA previously, chances are you are now, and must comply with Emergency FMLA’s new changes.

FFCRA also loosens the eligibility requirement for an employee to qualify for FMLA leave. Indeed, to be eligible for the Emergency FMLA’s benefits, an employee only has to have worked at least 30 days prior to taking the designated leave. An eligible employee may take up to 12 weeks of (now) paid, job-protected emergency leave for the statue refers to as “a qualifying need related to a public health emergency.” A “qualifying need” is defined as a situation in which the employee is unable to work or telework because they need to care for a minor son or daughter due to school or place of care being closed or the child care provider is unavailable due to COVID-19.

The first 10 days of Emergency FMLA leave may be unpaid. An employee may, however, elect to use accrued paid vacation or sick leave for some or all 10 days of unpaid leave, including the leave provided by the aforementioned Emergency Paid Sick Leave Act. Employers cannot, though, require the use of paid leave.

After the initial 10 days of potentially unpaid leave, though, an employer must pay an eligible full-time employee two-thirds of the employee’s regular rate for the number of hours the employee would have worked otherwise. Regarding part-time or varying-schedule employees, the same rule for the Emergency Paid Leave applies here: the employer pays either the average number of hours from the employee’s previous six months or the average number of hours expected at the time of hiring. Mercifully, the amended legislation limits the amount of required paid leave to only $200 per day and caps it at $10,000 total per employee.

As with “normal FMLA,” employers will generally be required to reinstate most employees who take this new FMLA leave. There may be limited exceptions to this reinstatement obligation for employers with fewer than 25 employees.

In addition to allowing the Secretary of Labor to exempt certain healthcare providers and emergency responders, the FFCRA authorizes the Secretary of Labor to exempt some small businesses with fewer than 50 employees if the imposition of such requirements would jeopardize the business as a going concern. How, when, or to whom the Secretary will apply these exemptions is unclear.

If there is a silver lining to this mess, it’s perhaps that the amended legislation exempts employers with fewer than 50 employees in a 75-mile radius (in other words, those who are not currently covered by FMLA obligations) from civil damages for FMLA charges. We’re not sure what this really means at this point, though, so we’re counseling compliance for all employers, regardless of size, until we see it play out in real life.

This Emergency FMLA expansion has a sunset provision at the end of the year.

How Do These Provisions Work Together?

The Emergency Paid Sick Leave and Emergency FMLA provisions are ostensibly supposed to work together. When an employer is covered by both provisions (which seems to be most employers), that employer must, at the employee’s request, allow the employee to use the employee’s newly minted 80 hours of Emergency Paid Sick Leave for the initial 10-day period of unpaid leave under the Emergency FMLA provision. That, presumably, bridges the employee with paid leave until the paid provisions of Emergency FMLA kick in. Again, no answers yet on how employers will afford to do so.

Employers should also be mindful that states are following the federal government’s lead and may be enacting or expanding their own paid sick leave or family and medical leave laws to address the COVID-19 virus. The federal laws, in other words, may just be the baseline obligations for multi-location employers – be sure to check the requirements of your specific jurisdiction.

What Next?

The current bill may undergo additional changes before becoming law. The underlying substance of the new obligations, though, will likely remain largely the same. We will keep you up to date with any changes to federal legislation.

We are committed to providing updates and as frequently as necessary, but please don’t hesitate to contact the Atlanta employment attorneys at Stanton Law immediately if you have any questions about the new federal or state laws for expanded sick or family and medical leave. We are available at 404-531-2341 or online.