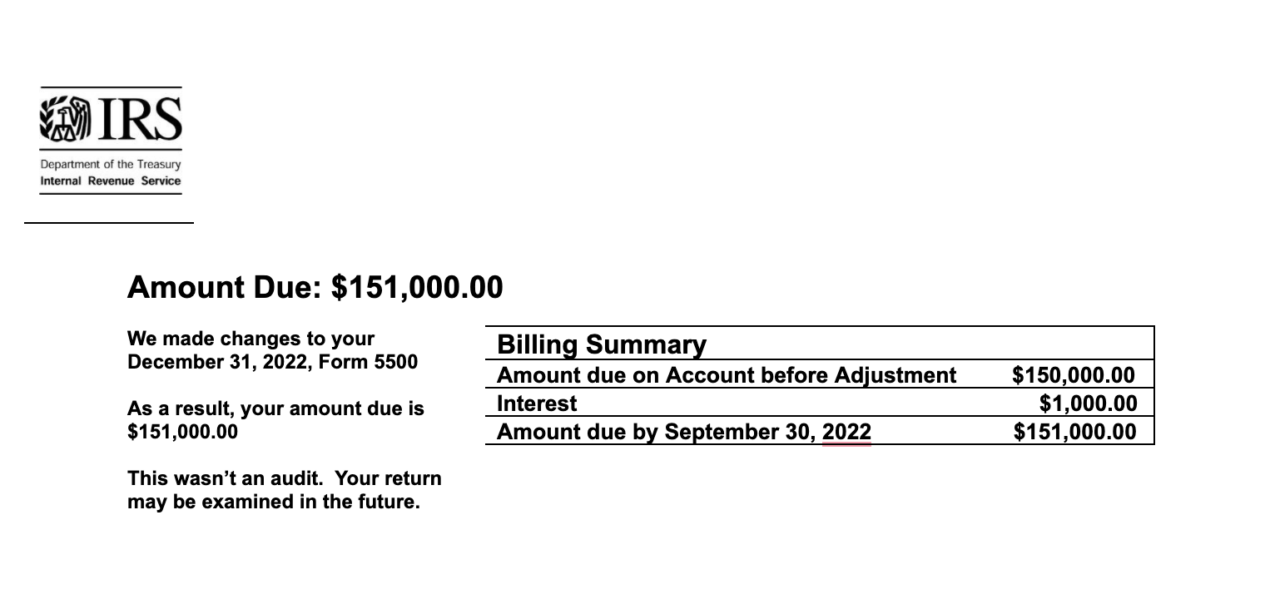

How would you feel if this arrived in the mail? What if you could prevent this problem before it arrived?

In 2022, it is likely that many companies may not be compliant with current tax and labor rules. These laws essentially apply to most small and mid-sized businesses, especially those that offer 401(k) plans or other retirement vehicles, health insurance, and/or deferred compensation or equity plans.

Many of the statutes impose fiduciary duties on the company’s owners and for those responsible for the plans, there may be an individual liability, too.

Stanton Law attorneys are known for providing business solutions to stop potential legal problems. Anna Grant has 40 years of experience helping businesses navigate the complexities of ERISA and tax and labor regulations.

By utilizing Anna’s expertise, employers can have more options and find it easier to budget for the solutions that will (almost certainty) be necessary, and given the potential consequences of non-compliant plans, should be prioritized.

We consider this stuff so important, we are offering a no-risk assessment of your health and financial plans. For $1,500, Anna will review up to three programs in your company’s benefits offerings. She will prepare a bullet-point summary of concerns, highlighting any non-compliance issues. Additionally, Anna will provide a preliminary budget and timeline to fix any problem areas.

If she does not find at least one issue with your plans that, if left unaddressed, would not result in more than $1,500 of liability, we will refund the full cost of the assessment.